Data Centre Hotspots

[Also published in the Techcapital Guest Blog: Tash Mehta 12/10/2021]

Data centres have long been largely overlooked by the investment community, but this is changing and the, once invisible, asset class is now attracting significant interest from all sectors of the investor community – banks, pensions funds, private equity, infrastructure funds and institutional investors. This can be attributable to solid and consistent growth coupled with an attractive blend of real estate and technology business that differentiates data centres from many other asset classes.

Data Centres are here to stay

Most recently, of course, the sector has been in the spotlight as dependence on online platforms mushroomed during lockdowns, putting the resilience and capacity of our digital infrastructure to the test. Data centres and communications networks successfully absorbed the resultant surge in demand – in contrast to the supply chain for toilet paper. So, while data centres will never attract the limelight, there is growing recognition that the sector is established, critical, growing Internationally and is here to stay.

So, with an abundance of investment now focussed on the data centre sector, where are the growth hotspots? To some extent, it is a case of ‘horses for courses’, with some funds focused on domestic investment opportunities and others on regional and Global. US and APAC investors are seeing a greater opportunity for growth in Europe where capacity lags behind the US, with impressive growth projections. However, the balancing of opportunity, risk and return is not straightforward. For instance, while the mature markets of Frankfurt, London, Amsterdam, Paris and Dublin (FLAP-D) continue to grow at pace, a high cost of entry and locational constraints such as access to power and network capacity can erode the returns when compared to emerging EMEA locations.

New Growth Hot Spots

As developments extend beyond these established Metros and away from city centre locations, the risk profile changes and with it the appetite and opportunity for investment. However, regional development is still needed. Cloud providers demand additional local coverage and hyperscale operators have been developing multiple sites for resilience, in order to provide geographical segregation from their primary locations. These large providers can be more flexible on location compared to commercial third party operators, are not tied to established European Cities and have much greater freedom to operate in second-tier locations. Indeed, when they do choose a new location for large scale development this is often a trigger for others to develop in the same district, with the potential to create an additional cluster for data centre services and a new investment hotspot. Investors able to predict where hyperscale deployments will be distributed may be well-positioned to benefit from early entry to a new market location.

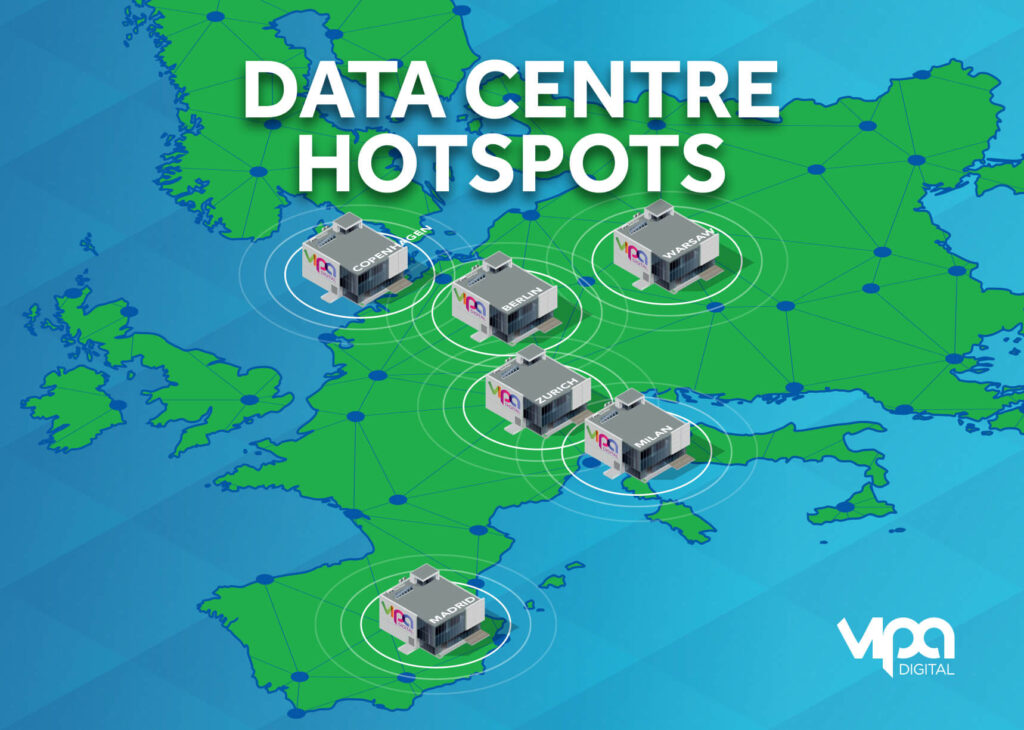

As capacity within established markets is absorbed, and opportunities for large scale deployments become exhausted, there will be scope for growth in tertiary, regional locations where edge computing drives a spread of computing capacity to satisfy local demand, but this may still take some time to be material in the market. In the meantime, investors have started to target up-and-coming second-tier national markets such as Berlin, Warsaw, Milan, Madrid, Copenhagen, and Zurich. There is also a focus on developments in emerging markets, like Africa, to support the growth of Global digital services.

Billions to Invest

As well as considering a broad range of locations, the investment community is also open-minded about assets – whether existing facilities, decommissioned sites ready for redevelopment or greenfield plots for new-build. Investors are often seeking to align the opportunity of the Data Centre asset class with a wider investment portfolio and with specific ambition for growth. Some require an existing business with immediate return and others can develop, literally, from the ground-up. Many funds are new to the space and are excited to have identified a business sector with such significant growth potential. It is important to consider that competition is fierce, with assets offered to the market attracting significant interest and cost premium.

Understanding the market dynamics in some detail, mapping investment decisions to Data Centres, selecting carefully the deals that balance the scale of investment, risk and potential return and understanding a longer-term growth or exit strategy will be key to participating in this exciting sector.